Home

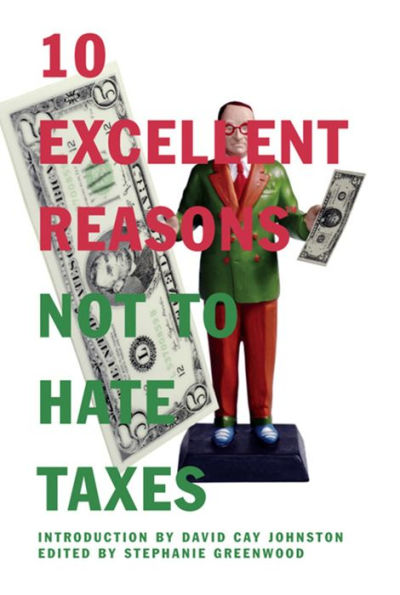

10 Excellent Reasons Not to Hate Taxes

Barnes and Noble

Loading Inventory...

10 Excellent Reasons Not to Hate Taxes in Franklin, TN

Current price: $13.95

Barnes and Noble

10 Excellent Reasons Not to Hate Taxes in Franklin, TN

Current price: $13.95

Loading Inventory...

Size: OS

Paying taxes. It's something almost everyone loves to hate.

10 Excellent Reasons Not to Hate Taxes

makes the case for thinking about taxes in a fresh and progressive way and offers plenty of material for anyone interested in countering the conservative anti-government, anti-tax agenda.

Written by activists, economists, teachers, political scientists, and business people,

offers an array of powerful arguments that will reframe the tax debate. Chapters on the effect of taxes on the economy, education, the environment, and the distribution of opportunity will arm readers with a wealth of arguments to turn the tables when thinking—or arguing—about taxes and provide a menu of ideas for how to transform the tax code into a tool for social justice.

With a January publication date, just when the tax preparation books and software flood the stores, this book will spark a lively and much-needed debate about all manner of tax issues, from the inheritance tax and flat taxes to tax cuts and the role that taxes play in the growing economic divide in the United States.

10 Excellent Reasons Not to Hate Taxes

makes the case for thinking about taxes in a fresh and progressive way and offers plenty of material for anyone interested in countering the conservative anti-government, anti-tax agenda.

Written by activists, economists, teachers, political scientists, and business people,

offers an array of powerful arguments that will reframe the tax debate. Chapters on the effect of taxes on the economy, education, the environment, and the distribution of opportunity will arm readers with a wealth of arguments to turn the tables when thinking—or arguing—about taxes and provide a menu of ideas for how to transform the tax code into a tool for social justice.

With a January publication date, just when the tax preparation books and software flood the stores, this book will spark a lively and much-needed debate about all manner of tax issues, from the inheritance tax and flat taxes to tax cuts and the role that taxes play in the growing economic divide in the United States.

Paying taxes. It's something almost everyone loves to hate.

10 Excellent Reasons Not to Hate Taxes

makes the case for thinking about taxes in a fresh and progressive way and offers plenty of material for anyone interested in countering the conservative anti-government, anti-tax agenda.

Written by activists, economists, teachers, political scientists, and business people,

offers an array of powerful arguments that will reframe the tax debate. Chapters on the effect of taxes on the economy, education, the environment, and the distribution of opportunity will arm readers with a wealth of arguments to turn the tables when thinking—or arguing—about taxes and provide a menu of ideas for how to transform the tax code into a tool for social justice.

With a January publication date, just when the tax preparation books and software flood the stores, this book will spark a lively and much-needed debate about all manner of tax issues, from the inheritance tax and flat taxes to tax cuts and the role that taxes play in the growing economic divide in the United States.

10 Excellent Reasons Not to Hate Taxes

makes the case for thinking about taxes in a fresh and progressive way and offers plenty of material for anyone interested in countering the conservative anti-government, anti-tax agenda.

Written by activists, economists, teachers, political scientists, and business people,

offers an array of powerful arguments that will reframe the tax debate. Chapters on the effect of taxes on the economy, education, the environment, and the distribution of opportunity will arm readers with a wealth of arguments to turn the tables when thinking—or arguing—about taxes and provide a menu of ideas for how to transform the tax code into a tool for social justice.

With a January publication date, just when the tax preparation books and software flood the stores, this book will spark a lively and much-needed debate about all manner of tax issues, from the inheritance tax and flat taxes to tax cuts and the role that taxes play in the growing economic divide in the United States.